IOLTA for Lawyers

Enrollment Requirements

If you are a lawyer in private practice in the state of Maryland, you must place all eligible client trust funds into an IOLTA account. Your escrow accounts and banking relations will remain the same, and Maryland Legal Services Corporation will pay reasonable and customary service charges on your IOLTA escrow account.

To establish IOLTA accounts, attorneys should complete the New IOLTA Account Enrollment form. Attorneys should give the original completed form to the bank and ensure the bank emails a copy to MLSC. Contact information can be found on page 2 of the form.

Download the Enrollment Form: [PDF] | [Word Doc]

Click here to see a list of financial institutions currently approved by the Attorney Grievance Commission to hold IOLTA deposits pursuant to Maryland rule 19-411.

IOLTA Honor Roll

By opening your IOLTA account at an IOLTA Honor Roll financial institution, you are going above and beyond in support of civil legal services for low-income Marylanders. Learn more about the Honor Roll.

Exceptions

All lawyers must comply with Maryland’s IOLTA law, but compliance does not necessarily require having an IOLTA account. You must open an IOLTA account if you are holding short-term or nominal trust funds of at least $3,500 on a regular basis.

If you are hold client trust funds but the average monthly balance is less than $3,500, you are eligible for a waiver, and you should open a non-interest-bearing escrow account. The waiver is elected when you submit the Annual IOLTA Compliance Report.

If you do not hold any client trust funds due your professional activities (retired, government service, not in private practice, corporate counsel, etc.), you do not need to open an escrow account. You will certify such activities when you submit the Annual IOLTA Compliance Report.

If either of the above circumstances change, you must establish an IOLTA account and notify MLSC.

Compliance Reporting Requirements

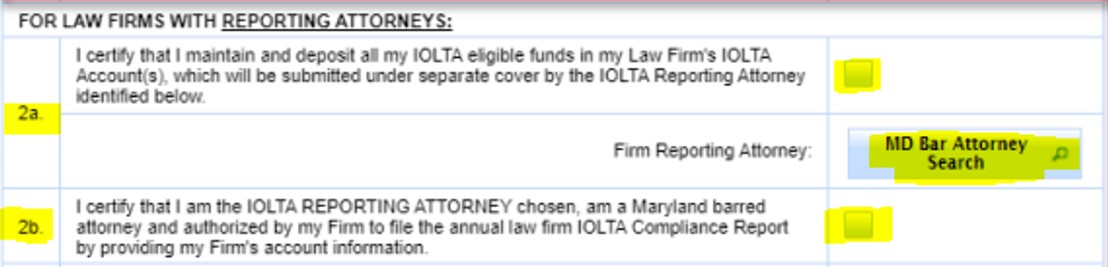

All Maryland-admitted attorneys are required to report annually on their compliance with Maryland’s IOLTA program. The Administrative Office of the Courts will send all annual compliance filing notifications electronically – no paper reports will be mailed. Annual compliance reports MUST be filed online using the Attorney Information System. The annual notices will be sent in mid-July, with an annual deadline to file compliance reports of September 10.

MLSC cannot update your contact information. You must ensure your information is up-to-date in AIS.

If you have technical questions regarding registering for or using AIS, please contact Service Now at (410) 260-1114. If you have questions regarding IOLTA, please review the below FAQs and contact us.

Please note one change in compliance options this year for clarity: If you conduct legal activities in Maryland, but hold your IOLTA account in the District of Columbia or a contiguous state, select option 4 and indicate the jurisdiction. If you do not conduct legal activities in Maryland (and therefore do not need a Maryland IOLTA account, even if you may hold an IOLTA account in another state), please select option 5.